MO CDTC-770 2014-2025 free printable template

Show details

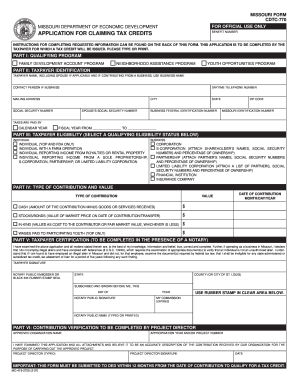

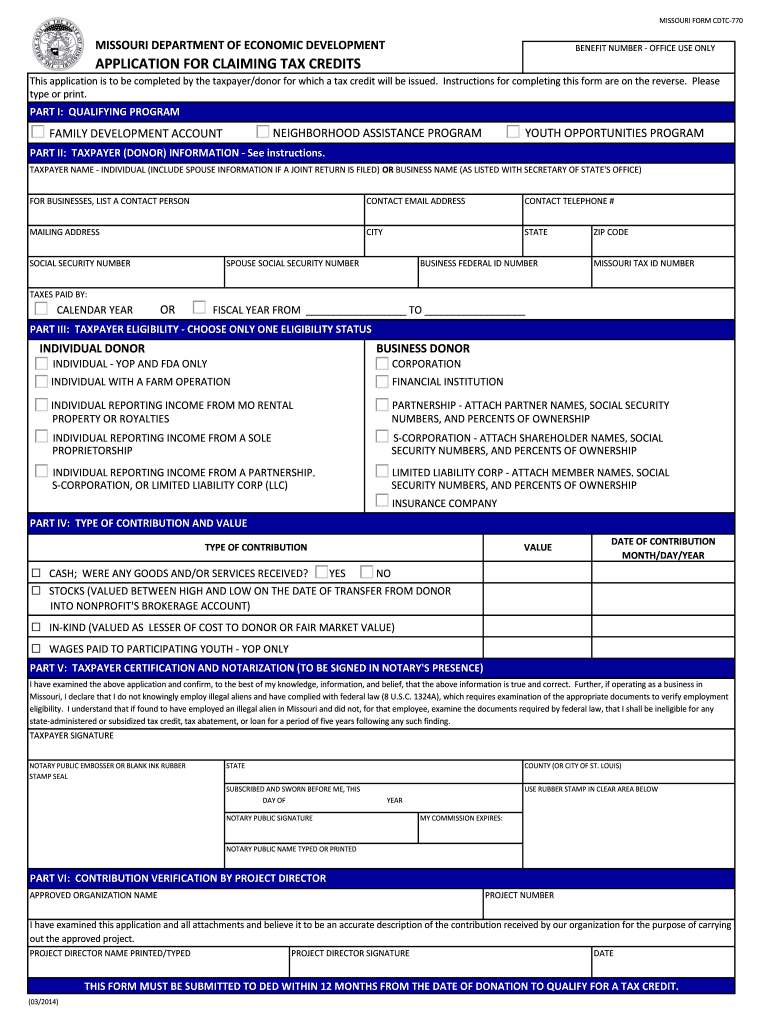

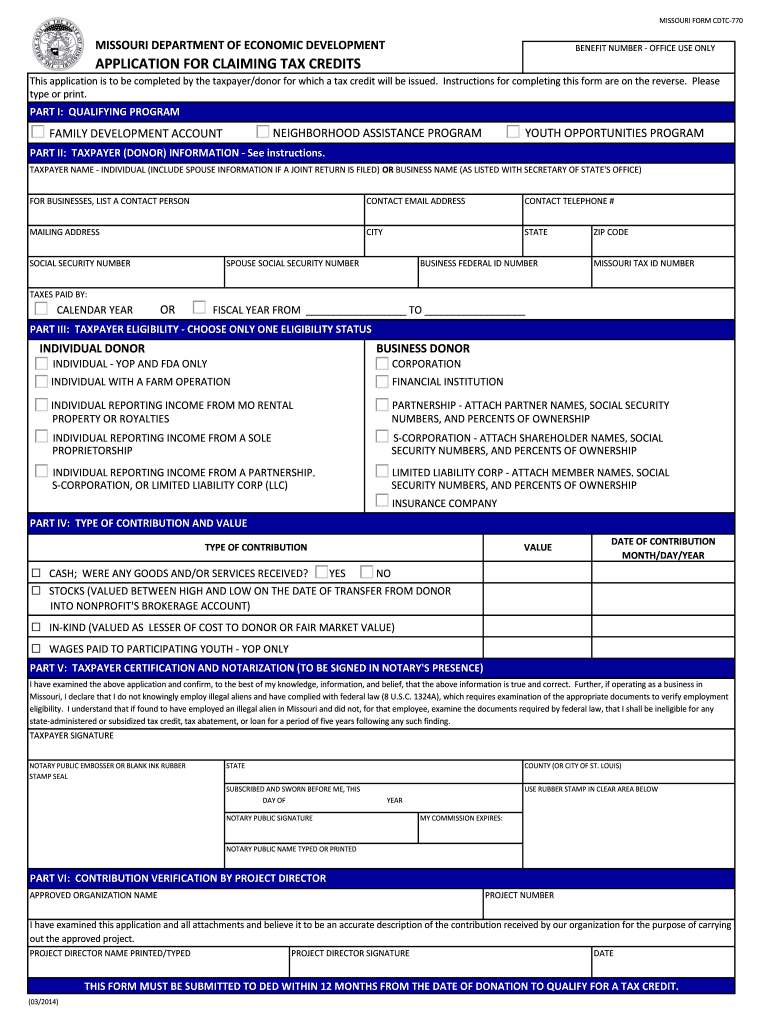

03/2014 INSTRUCTIONS FOR COMPLETING MISSOURI FORM CDTC-770 Neighborhood Assistance NAP Youth Opportunities YOP or Family Development Account FDA Programs. MISSOURI FORM CDTC-770 MISSOURI DEPARTMENT OF ECONOMIC DEVELOPMENT BENEFIT NUMBER - OFFICE USE ONLY APPLICATION FOR CLAIMING TAX CREDITS This application is to be completed by the taxpayer/donor for which a tax credit will be issued. Instructions for completing this form are on the reverse. Please type or print* PART I QUALIFYING PROGRAM...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO CDTC-770

Edit your MO CDTC-770 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO CDTC-770 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MO CDTC-770 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MO CDTC-770. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO CDTC-770 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO CDTC-770

How to fill out MO CDTC-770

01

Obtain the MO CDTC-770 form from the Missouri Department of Revenue website or your local office.

02

Fill out the header section with your personal information, including your name, address, and Social Security number.

03

Provide details of your income sources in the applicable sections.

04

Report any tax credits or deductions you are claiming.

05

Double-check your entries for accuracy and completeness.

06

Sign and date the form at the bottom.

07

Submit the completed form to the designated state office either by mail or electronically if allowed.

Who needs MO CDTC-770?

01

Individuals who are filing a state income tax return in Missouri and seeking tax credits.

02

Taxpayers who have specific income types that require reporting on the CDTC-770.

03

Residents claiming deductions on their Missouri state taxes.

Fill

form

: Try Risk Free

People Also Ask about

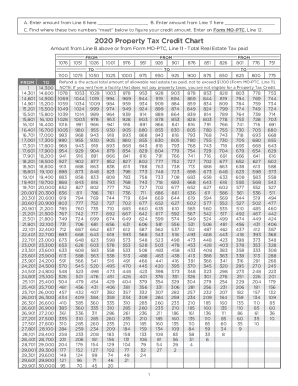

What is the income limit for mo property tax credit?

Certain individuals are eligible to claim up to $750 if they pay rent or pay real estate tax on the home they own and occupy. Total household income must be $25,000 or less if filing single or $27,000 if married filing combined.

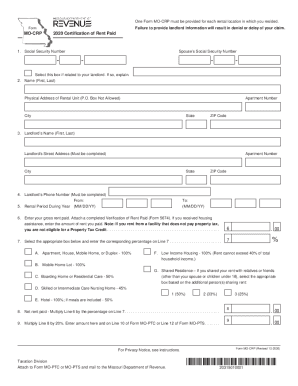

Who is eligible for Missouri property tax credit?

ing to Section 135.010 of the state statutes, the Property Tax Credit can only be claimed by a person who lives on or pays rent on a property on which property tax is paid. If a person, group, or governmental entity does not pay any property tax on a property, no one living on that property can claim the credit.

At what age do you stop paying property taxes in Mo?

65 years of age or older, or. a person 18-64 who receives SSI, SSD, or Veterans Disability, or. 60 and older and receiving Surviving Spouse benefits from SSA.

What age do you stop paying property taxes in Missouri?

65 years of age or older, or. a person 18-64 who receives SSI, SSD, or Veterans Disability, or. 60 and older and receiving Surviving Spouse benefits from SSA.

What is the Missouri caregiver tax credit?

The Missouri Shared Care Tax Credit provides a tax credit to help families offset up to $500 of expenses incurred caring for an elderly person (age 60 or older). To qualify, you must register each year with division of senior and disability services. Read more

Does Missouri offer a senior discount on property taxes?

The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MO CDTC-770 in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your MO CDTC-770 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send MO CDTC-770 for eSignature?

When you're ready to share your MO CDTC-770, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I edit MO CDTC-770 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign MO CDTC-770. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is MO CDTC-770?

MO CDTC-770 is a tax credit form used in Missouri for individuals and businesses to claim the Missouri Tax Credit for Taxes Paid to Other States.

Who is required to file MO CDTC-770?

Taxpayers who have paid taxes to another state and are seeking a tax credit on their Missouri tax return are required to file MO CDTC-770.

How to fill out MO CDTC-770?

To fill out MO CDTC-770, complete the form by providing your personal information, the state where taxes were paid, the amount of taxes paid, and any required documentation to support the credit claim.

What is the purpose of MO CDTC-770?

The purpose of MO CDTC-770 is to allow taxpayers to claim a credit for income taxes paid to other states, thereby preventing double taxation.

What information must be reported on MO CDTC-770?

MO CDTC-770 requires reporting of your name, Social Security number or Tax ID, the state where taxes were paid, the amount of taxes paid to that state, and any other relevant details as specified in the form instructions.

Fill out your MO CDTC-770 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO CDTC-770 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.